New York City Amends the Earned Safe and Sick Time Act

New York City amended the Earned Safe and Sick Time Act (“ESSTA”) to align with the requirements of the New York State Paid Sick Leave Law. Among the changes are new requirements for certain small employers to provide paid safe/sick time and for large employers to provide employees with more safe/sick time than ESSTA previously required. October 20, 2020

On September 28, 2020, Mayor de Blasio signed a bill into law intended to align ESSTA with New York State’s Sick Leave Law. The changes went into effect on September 30, 2020. However, some benefits will not be available to employees until January 1, 2021.

Some Small Businesses Must Provide Paid Safe/Sick Time

With these amendments, ESSTA now requires employers with four (4) or fewer employees that had a net income of $1 million or more in the previous tax year (“Small Employers”) to allow employees to accrue up to forty (40) hours of paid safe/sick time per year at a rate of one (1) hour of paid safe/sick time for every thirty (30) hours worked. Eligible employees of Small Employers may begin using accrued paid safe/sick time on or after January 1, 2021. Although ESSTA is not clear whether eligible employees of these Small Employers will begin accruing safe/sick time immediately, New York State’s Sick Leave law requires all employers to allow eligible employees to begin accruing safe/sick time as of September 30, 2020 so Small Employers in New York City should comply with the State law and begin tracking paid safe/sick time accrual immediately. Small Employers are not required to allow eligible employee to use paid safe/sick time until January 1, 2021. Employers with four (4) or fewer employees that had a net income of less than $1 million in the previous tax year continue to be required to provide forty (40) hours of unpaid safe/sick time.

Large Businesses Must Provide Additional Paid Safe/Sick Time

Under the amended law, ESSTA now requires employers with one hundred (100) or more employees (“Large Employers”) to allow employees to accrue up to fifty-six (56) hours of paid safe/sick time each year at a rate of one (1) hour of paid safe/sick time for every thirty (30) hours worked. Employees of Large Employers may not use any accrued safe/sick time that exceeds forty (40) hours per calendar year until January 1, 2021.

The requirements of ESSTA (allowing employees to accrue up to forty (40) hours of paid safe/sick time per year) remain the same for employers of 4 or more employees in New York City who are not Small Employers or Large Employers as addressed above.

Use of Paid Safe/Sick Time

As of September 30, 2020, employers (regardless of employer size or net income) are no longer permitted to delay use of accrued safe/sick time for up to one hundred and twenty days. Employees also are no longer required to meet a minimum number of hours worked per year (ESSTA previously required a minimum of eighty (80) hours per year worked to be eligible for safe/sick time).

Effective October 1, 2020:

- Employees who were previously eligible to accrue, but not yet use ESSTA safe/sick time (e.g., because they were in a waiting period of up to one hundred and twenty days) are able to use accrued safe/sick time up to forty (40) hours of safe/sick time as it is accrued.

- Employees of Large Employers may begin to accrue up to fifty-six (56) hours of safe/sick leave, however, they may not use any hours accrued in excess of forty (40) until January 1, 2021.

- Employees of Small Employers who were not eligible for paid safe/sick time prior to September 30, 2020 may begin to accrue paid safe/sick time effective October 1, 2020, however, they may not use paid safe/sick time until January 1, 2021.

Carrying Over Unused Safe/Sick Time

Carryover of unused safe/sick time is required unless an employer adopts a policy that meets or exceeds the requirements of ESSTA and front loads time on the first day of each year. Covered employers with ninety-nine (99) or fewer employees must allow employees to carry over up to forty (40) hours of unused accrued safe/sick time each year, however, such employers are not required to allow employees to use more than forty (40) hours of safe/sick time per year. Large Employers must allow employees to carry over up to fifty-six (56) hours of unused accrued safe/sick time each year, however, Large Employers are not required to allow employees to use more than fifty-six (56) hours of safe/sick time each year.

Notice of Employee Rights and Accrual and Usage of Safe/Sick Leave

Employers must provide newly hired employees with notice of their rights under the law upon hire and provide existing employees with a revised notice of employee rights under ESSTA by October 30, 2020. As of the issuance of this alert, New York City has not provided an updated notice of rights.

Employers must also provide employees with up to date information regarding the amount of safe/sick time accrued and used by the employee during each pay period and the employee’s total balance of safe/sick time. This information may be provided on the employee’s wage statement or another written document provided to the employee each pay period.

Employer Policies

The law provides the minimum requirements for safe/sick time and does not prohibit employers from adopting leave policies that provide leave that is equal to or greater than the amount of safe/sick leave provided by ESSTA. The amended ESSTA does not prohibit employers from adopting a leave policy that encompasses safe/sick time under ESSTA, or that frontloads leave.

Reimbursement for Documentation

The amended ESSTA requires employers to reimburse employees for costs associated with documentation required by the employer for the use of safe/sick time. Reimbursement is required if the employee is requested to provide documentation from a health care provider, and that health care provider charges the employee for the provision of documentation. Reimbursement is also required if the employee is requested to provide documentation that the use of safe time is authorized by ESSTA. Reimbursements for documentation of safe time should include the reasonable costs or expenses incurred for the purpose of obtaining such documentation. Employers may only require documentation from an employee if the employee has been absent from work for more than three (3) consecutive workdays for either safe or sick time.

Additional Provisions

Additional amendments to ESSTA include, but are not limited to, increasing safe/sick time for domestic workers from two (2) days to forty (40) hours of paid safe/sick time each year (there is no corresponding State law requirement unless the employer hits a threshold to provide paid leave), clarifying the rate of pay for employees taking safe/sick time, and protecting employees from suffering any adverse action for using or attempting to use safe/sick time.

Remaining Differences from New York State’s Sick Leave Law

ESSTA has a more expanded definition for the term “family member” for purposes of safe/sick leave than New York State’s Paid Sick Leave. Under ESSTA, a “family member” includes “any other individual related by blood to the employee; and any other individual whose close association with the employee is the equivalent of family relationship.” This is omitted from the definition of “family member” under the New York State Sick Leave Law, however, the State law permits cities to provide greater benefits and to run the time under the sick leave laws concurrently. Employees eligible only under the State law (e.g., who work outside of New York City) are not required to be able to take safe/sick leave for these expanded reasons.

Additionally, ESSTA allows eligible employees to use accrued safe/sick time in the event of a closure of the employee’s place of business by order of a public official due to a public health emergency, or the employee’s need to care for a child whose school or childcare provider has been closed by order of a public official due to a public health emergency. While New York State’s Paid Sick Leave Law does not allow employees to take leave for similar reasons, New York State has adopted a separate emergency paid sick leave law for COVID-19 related reasons.

Where the laws between the State and ESSTA differ, employers should provide employees with the greater benefit.

New York State COVID-19 Sick Leave

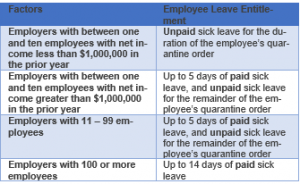

In response to the COVID-19 pandemic, New York State enacted a COVID-19 paid sick leave law that is separate from New York State’s Paid Sick Leave Law and vacation or PTO benefits, and is available to employees who are subject to mandatory or precautionary orders of quarantine due to COVID-19. The COVID-19 sick leave entitlement varies based on the employer’s size and net income. Employers must provide emergency COVID-19 paid sick leave as follows:

New York’s emergency COVID-19 sick leave is separate from, and must be provided without, loss of the employee’s accrued sick leave under any other sick leave law. Employees may opt to use other benefits, such as PTO or vacation leave, to supplement periods of leave which are not paid by the employer pursuant to New York’s emergency COVID-19 sick leave. Employees may also be eligible for compensation under New York Paid Family Leave or Disability Benefits during the unpaid periods of COVID-19 sick leave.

Differences from Westchester County

As of the issuance of this alert, Westchester County has not amended its Earned Sick Leave Law or Safe Time Leave Law to align with the New York State Sick Leave Law. Although Westchester County law continues to require employees to work for ninety (90) days before using safe/sick time, employers must comply with the State law which allows for immediate use. Westchester County employees further remain eligible to accrue up to forty (40) hours of sick time and an additional forty (40) hours of safe time each year. Where the laws between the State and Westchester County differ, employers should provide employees with the greater benefit.

Practical Guidance

Employers should review their PTO and sick leave policies and update as needed to comply with the New York State Paid Sick Leave Law and amended ESSTA, and take steps to ensure employees are provided with accurate information regarding their safe/sick time accrual and use. Employers should ensure employees’ wage statements provide the appropriate safe/sick time accrual and use information to employees, or adopt another method for providing this information each pay period. Employers should also keep an eye out for a revised notice of rights from New York City, and prepare to distribute the updated notice on or before October 30, 2020.

Click here for a pdf of this alert.